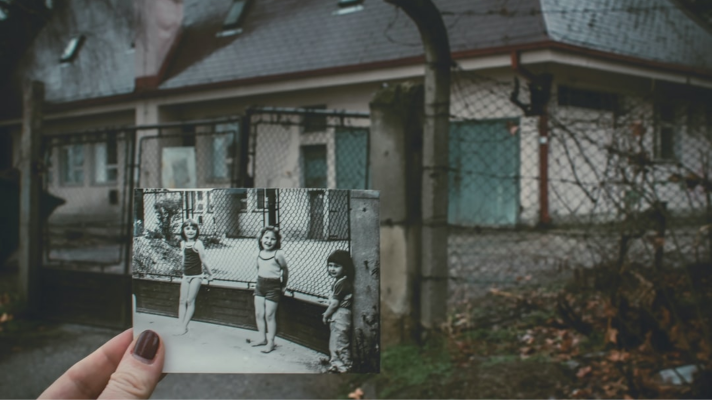

Inheriting a house can come with some complicated emotions. Receiving a property is often the result of a family member or loved one’s death. While you may be grieving, you’ll also need to navigate some complex and confusing financial decisions — will you sell your house, move in, rent it out? And how will that decision affect your financial status? That’s where we come in. Read on for a basic breakdown of what to do when you inherit a house.

You Have 3 Options

Before making a decision, you’ll need to consider whether or not you are the sole recipient of the property or if there are multiple stakeholders. It’s common to inherit a home with another person, like a sibling. If you share ownership, all parties will need to be in agreement in regards to the next step. But essentially, you have three options.

You can:

- Move into your house

- Rent out your house

- Sell your house

If you don’t yet own a home and you’re renting your current residence, moving in might be the perfect option. Becoming a homeowner allows you a lot more freedom and flexibility than renting a house or apartment. On the other hand, maintaining a home can be costly and time-consuming. For that matter, so can renting out your home. Being a landlord is not an easy job, but when done properly, it can be quite lucrative. Finally, selling your house can take the unwanted property off your hands and put money directly into your pocket.

What Are the Tax Implications?

Upon inheriting a house, you might be wondering, “Do I have to pay an inheritance tax on this property?” The answer is that inheriting a house does not lead to automatic tax liability; however, what you decide to do with the property will incur property taxes, capital gains taxes, or various other expenses.

Obviously, if you choose to live in the house, you will need to pay property taxes. That one is self-explanatory. But what are capital gains taxes? They are what you pay to the federal government based on the profits you earn from the sale of the home. Fortunately, when you inherit a house, you’ll most likely be protected from capital gains taxes because of the step-up tax basis. The step-up tax basis means that you inherit the property at the fair market value on the date of inheritance; you’ll only be taxed on any gains that occur between the date on which you inherit the home and the day you sell it. In this case, you will want to sell your house fast to avoid higher taxes due to the value increasing over time.

How to Sell Your House Quickly

Want to sell your house fast? Your best option is likely to sell to cash home buyers. Cash closings often occur up to 15 days faster than a closing requiring a mortgage. Selling to a cash home buyer is not like selling through an agent; you won’t need to wait to see if the buyer can get financing. When you choose to sell your inherited home to En-Vision Home Solutions, we buy your house as-is — no need for repairs, no hidden fees or commission costs. We will give you a fair all-cash offer within 24 hours and can close as quickly as seven days.